Times Interest Earned Ratio Interpretation

For example a company has 10000 in EBIT and 1000 in interest payments. In other words the time interest.

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Earnings before interest and taxes.

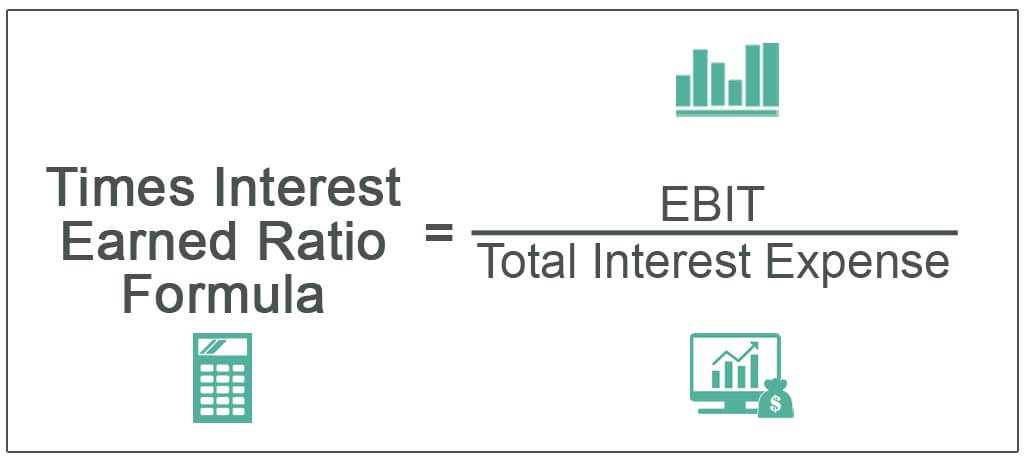

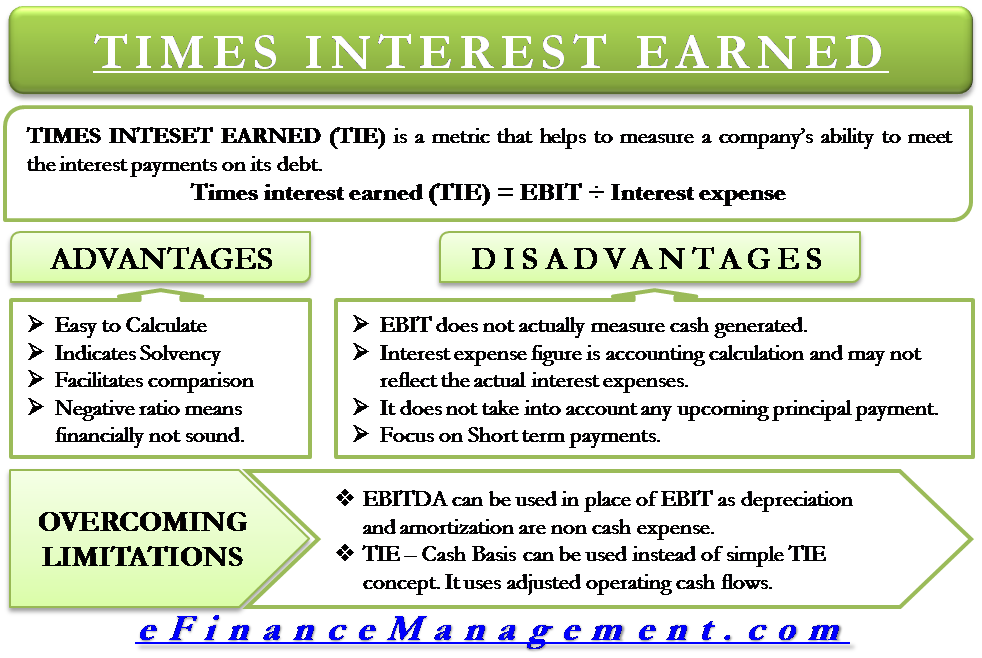

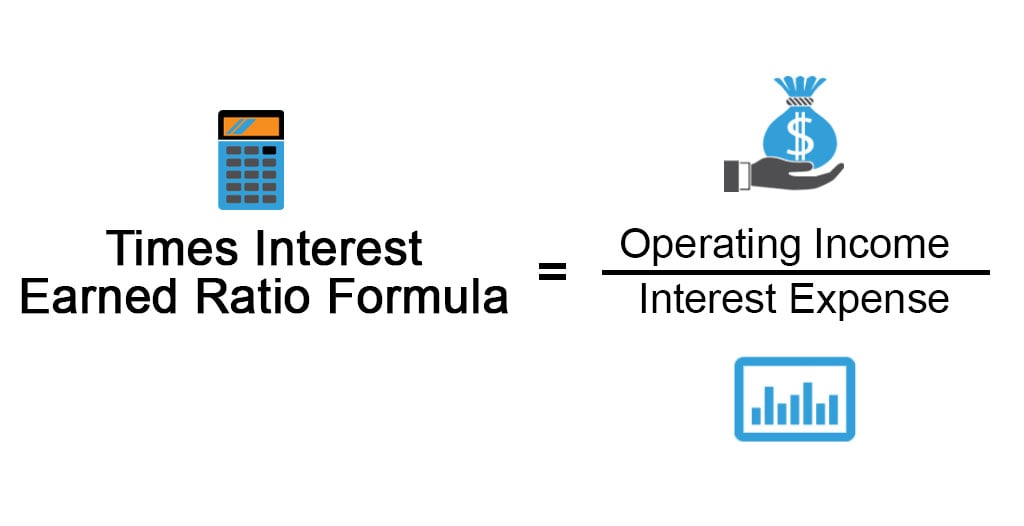

. The ratio gives us the number of times. It is based on this. The Times Interest Earned ratio can be calculated by dividing its earnings before interest and taxes EBIT by its periodic interest expense.

The times interest earned ratio also known as interest coverage ratio is a measure of how company can pay its interest on outstanding debt. Times Interest Earned Ratio Meaning Formula Calculate From 2008 to 2009 Revenues increased by 1210 68281 in 2009 versus 60909 in 2008. It is calculated by dividing a companys EBIT by its.

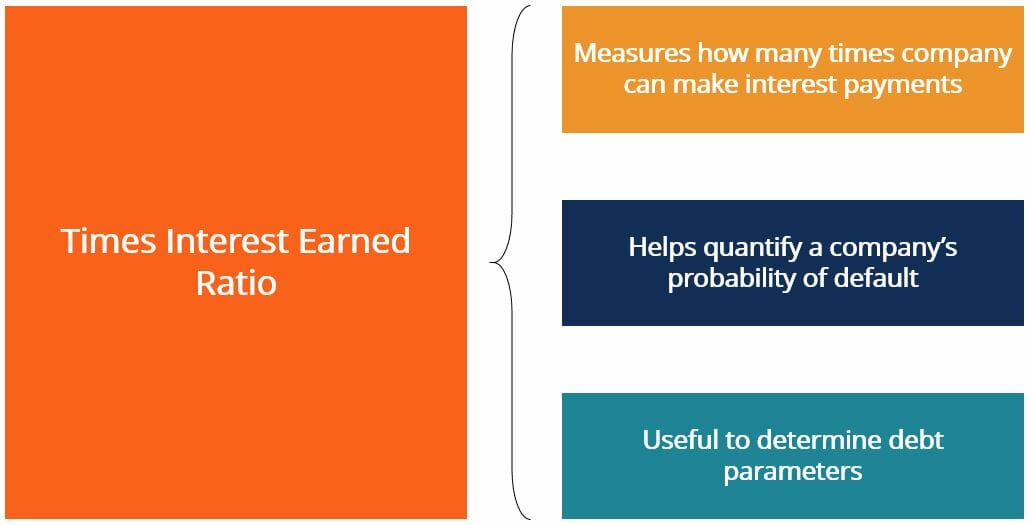

The Times Interest Earned ratio TIE measures a firms solvency and whether it can make enough money to pay back any borrowings. To further understand TIE ratios check out the following times interest earned ratio example. Time Interest Earned Ratio Calculation.

Tims income statement shows that he made 500000 of income before interest expense and income taxes. The higher the ratio the more times over its EBIT can meet its interest expense the easier it can service its debt and the safer a business appears to be. The times interest earned ratio or TIE ratio is a financial ratio used to assess a companys ability to satisfy its debt with its current income.

Skip to the content. Company DEA has an operating income of 200000 before taxes. Tims overall interest expense for the year was only 50000.

The result illustrates how many times the company can cover its interest payments with its current income. The times interest earned ratio calculates the number of times that earnings can. In other words it indicates how well a company can cover its debt.

To calculate the times interest earned ratio we simply take the operating income and divide it by the interest expense. Time Interest Earned Ratio Interpretation By Jo_Mia806 14 Sep 2022 Post a Comment. Debt ratio of Company A.

The formula to calculate the ratio is. The times interest earned ratio is a solvency metric that evaluates how well a company can cover its debt obligations. A ratio of 1 is usually considered the middle ground.

Interest Coverage Ratio also known as Times Interest Earned Ratio TIE states the number of times a company is capable of bearing its interest expense obligation from the operating. It is a long-term solvency. In other words a ratio of 4 means that a.

The times interest earned ratio or TIE can also be called the interest coverage ratio. We can assess the solvency of the companies by calculating and comparing debt ratio and times interest earned ratio for both the companies which are as follows. The Times Interest Earned ratio measures a companys ability to make its interest payments on time.

For example Company As TIE ratio in Year 0 is 100m divided by 25m. The times interest earned ratio sometimes called the interest coverage ratio is a.

Times Interest Earned Learn How To Calculate An Use The Tie Ratio

Times Interest Earned Tie Ratio Formula And Calculator Excel Template

Times Interest Earned Ratio Debt To Total Assets Ratio Analyzing Long Term Debt Youtube

Times Interest Earned Formula Advantages Limitations

Times Interest Earned Ratio Meaning Formula Calculate

Times Interest Earned Ratio Formula Examples With Excel Template

0 Response to "Times Interest Earned Ratio Interpretation"

Post a Comment